Originally published in CEOWorld February 12 2022

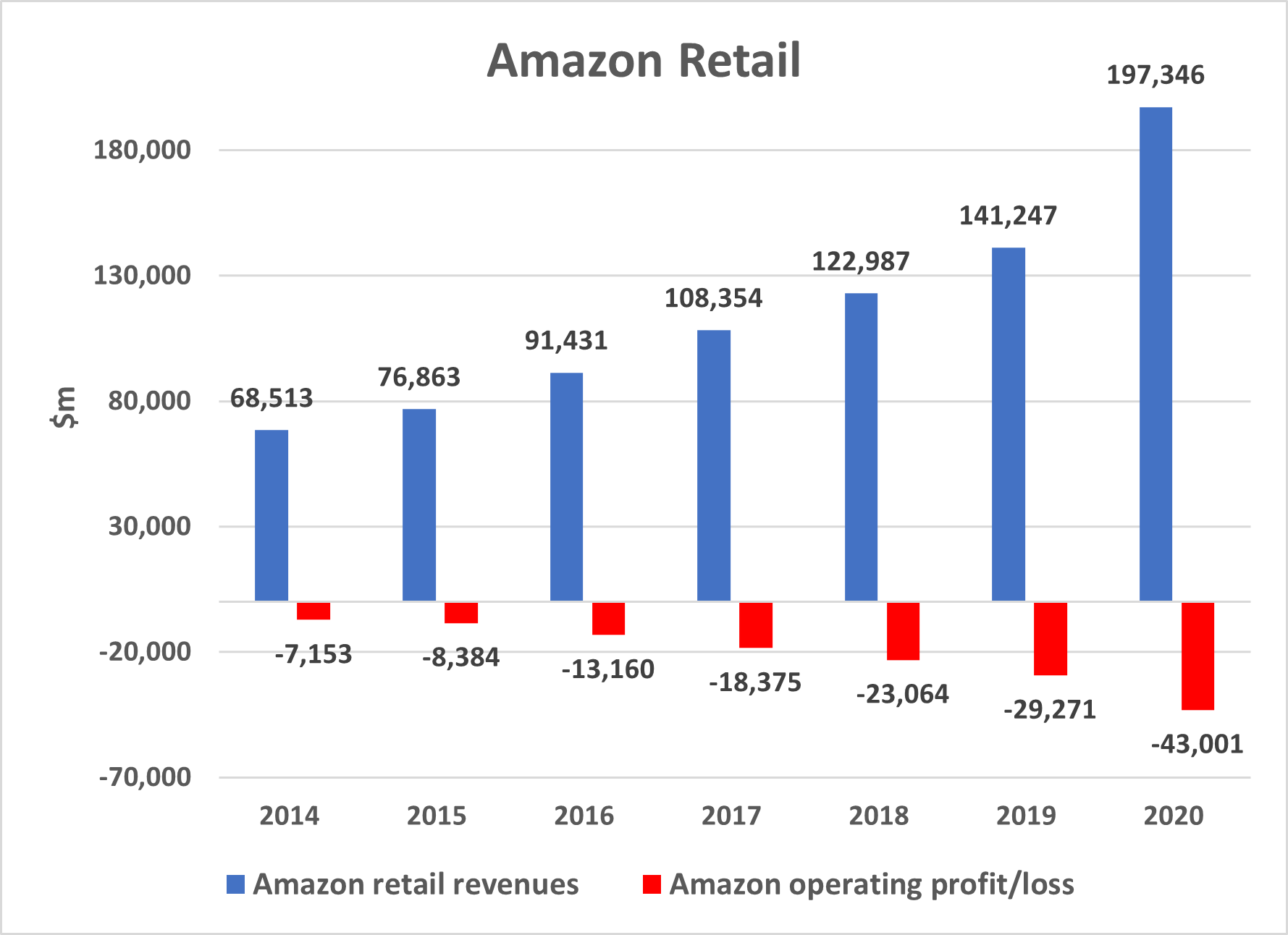

Retail is, conceptually, pretty simple. A retailer buys in stock, marks it up, and sells it to a customer. When executed well, the retailer makes money – enough to pay for business operations, a profit, and the items that didn’t sell. That model goes back at least 3,000 years, and it’s still the dominant model today.

Of course, there are variations. Sam’s Club and Costco, for example, charge a modest annual fee, which adds to revenue. Big retailers have learned they can charge (a lot) for prime placement within the store. In some industries, retailers have imposed sale or return policies – publishers know they have to offer booksellers the option to return unsold books if they want those orders to keep flowing. Still, the basics are still pretty simple: overwhelmingly, revenues come from sales.

Amazon is different. It has developed a new retail model, where revenues from sales are only one of four important revenue streams. TAs a result, revenues from customers are a much lower percentage of total Amazon Retail revenues, which in turn allows Amazon to charge those customers lower prices. Obviously, this is a huge advantage.

How does this work?