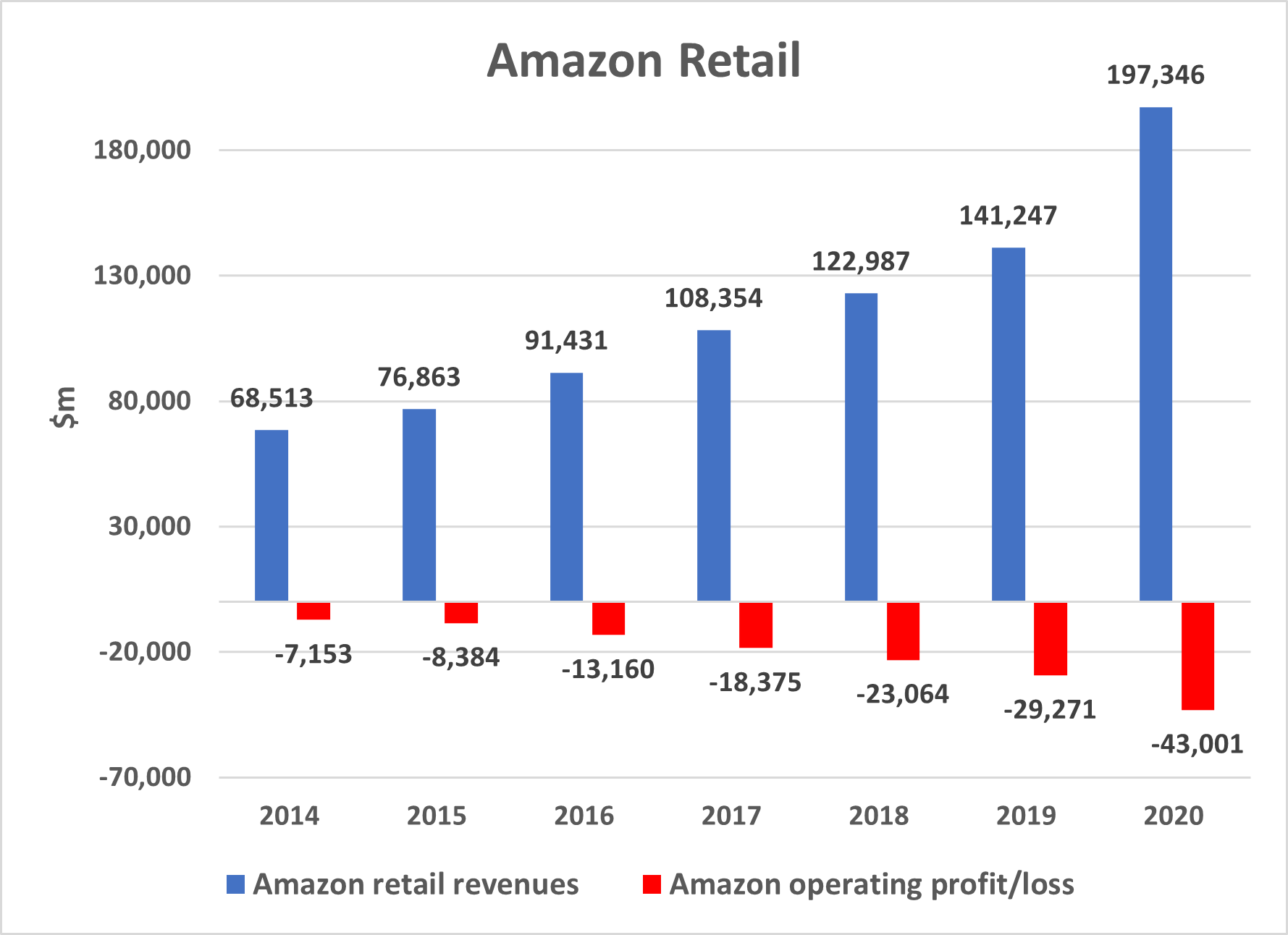

Amazon’s most recent 10k filing with the SEC confirmed – accelerated – existing trends. While Amazon works hard to obfuscate results for its major segments, a careful analysis shows that Amazon Retail’s losses have accelerated every year since 2014, and reached the staggering total of $43 billion in 2020: that’s a negative operating margin of 21.8 percent, up from 20.7 percent in 2019, while retail revenues grew by $56 billion.

Source: Amazon 10k reports; author calculation. A detailed discussion of the methodology used is in chapter 9 of Behemoth, Amazon Rising: Power and Seduction in the Age of Amazon

Why is the ocean of red ink growing? There are a few obvious reasons:

- Too many supply chains to manage. By 2016, Amazon has 13 millions for sale through its retail division. That number has undoubtedly grown since then. Managing supply chains for many millions of items is beyond challenging.

- Extension into the wrong retail segments. Challenging IKEA on price is a fool’s errand. In too many segments, Amazon faces well established competitors with a better understanding of their business.

- The Marketplace challenge. Amazon’s Marketplace has attracted 2 million sellers. Many specialize in a handful of SKU’s, which they understand completely, and where they can compete effectively against the great white whale that is Amazon Retail.

- Chinese manufacturers. By opening the direct pathway between Chinese manufacturers and American consumers, Amazon has in effect disintermediated itself.

In my next post, I’ll explain how Amazon can shrink the red ink quickly and efficiently.

- Failed automation? Amazon has over the past few years tried to automate the product buyer function, replacing industry buyers through the “Hands off the wheel” initiative. There is no sign that this is being successful. In the contrary.