Amazon has been all over the news the last 24 hours, with Bezos stepping down and Amazon roaring past $100 billion in revenue in Q4 2020. Those are both important stories – but under the hood, it’s the accelerating shift away from Amazon retail and toward the Amazon Marketplace that really matters.

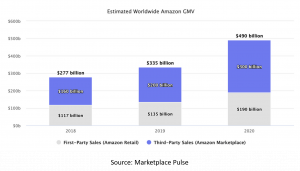

The chart below from Marketplace Pulse tells the story. Total GMV (sales) across the Amazon retail platform reached almost $500 billion. Marketplace sales are up 50% – even though non-essentials sellers were deprioritized in favor of COVID necessities. So Amazon’s total sales have almost surpassed Walmart, and will do almost certainly in 2021. Another year like 2020 and Walmart will be receding fast in the rear-view mirror.

But there’s an even more important important story here. Amazon is continuing it’s shift away from its own retail operations (Amazon retail), towards its enormous third-party Amazon Marketplace. Over the past 15 years or so, that shift has averaged around 2-2.5% annually. In 2020, the Marketplace share reached more than 60% for the first time, at 61.2%.

This ongoing shift is not surprising. Amazon retail loses money – a lot of money – as I show in Behemoth, Amazon Rising. Conversely, Marketplace made about $17.8 billion in operating revenue in 2019, a margin of 33.1%. It makes perfect sense for Amazon to transition away from its own retail business and into it’s increasingly dominant role as the platform manager.